nh transfer tax calculator

0 5 tax on interest and dividends Median household income. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases.

Payment of the RTF is a prerequisite for recording the deed and it should be noted that in addition to.

. The amount of New. What is the Real Estate Transfer Tax RETT. Nh transfer tax calculator.

The statute imposing the tax is found at RSA 78. New Hampshire income tax rate. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases.

Our calculator has recently been updated to include both the latest. An original Form PA-34 Inventory of Property Transfer. How much is the real estate transfer tax in New Hampshire.

On any amount above 400000 you would have to pay the full 2. The total transfer tax for NH is. The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

The assessed value multiplied by the tax rate equals the annual. TAX ON TRANSFER OF REAL PROPERTY. Nh real estate transfer tax calculator.

A A tax is imposed upon the sale granting and transfer of real estate and any interest therein including. Select PUD if property is in a Homeowers Association. Your average tax rate is 1198 and your.

The tax is assessed on both the buyer and seller upon the transfer sale or granting of real property or an interest in real property. Nh Transfer Tax Calculator. New Hampshire Income Tax Calculator 2021 If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

NJ Transfer Tax Calculator Customarily the New Jersey Transfer Tax is paid by the seller and the Mansion Tax on residential or commercial purchases of 1 million or more is paid by the buyer. 9 rows If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. The New York State Transfer Tax is 04 for sales below 3 million and 065 for sales of 3 million or more.

The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. The Real Estate Transfer Tax RETT was enacted in 1967.

We do this by matching your vehicle to similar vehicles in our database of actual registrations and providing you with both the average cost and the. The higher rate of 065 kicks-in at a lower threshold of 2 million for. You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

Census Bureau Number of cities that have local income taxes.

South Dakota Real Estate Transfer Taxes An In Depth Guide

New Hampshire Income Tax Calculator Smartasset

New Hampshire Income Tax Nh State Tax Calculator Community Tax

How To Calculate Transfer Tax In Nh

Property Taxes Nh Issue Brief Citizens Count

Rate Calculator Nh Absolute Title Llc New England S Premier Title Company

Florida Property Tax H R Block

Stratham Summer Fest 2022 Town Of Stratham Nh

5 Things You Can Do From Our New Website

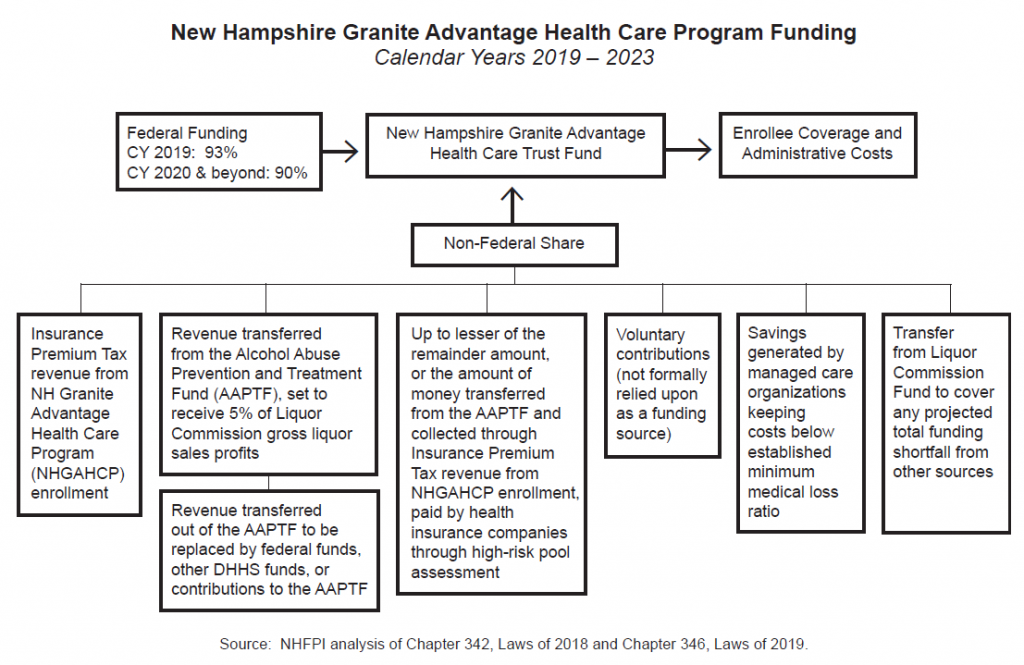

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Calculate Your Transfer Fee Credit Iowa Tax And Tags

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Transfer Tax Calculator 2022 For All 50 States

Property Transfer Among Family Members H R Block

Sales Taxes In The United States Wikipedia

Dmv Fees By State Usa Manual Car Registration Calculator

Should You Move To A State With No Income Tax Forbes Advisor